[Traditional Remedial Teaching Material]

Hello students, we are going to learn the units journal ledger, trail balance through traditional method by using different methods and activities of teaching in a simple way.

Objectives of the method

Hello students, we are going to learn the units journal ledger, trail balance through traditional method by using different methods and activities of teaching in a simple way.

Objectives of the method

- To explain the importance of accounting

- To have a clear knowledge of Journal, Ledger and Trial Balance

- To understand the rules in preparation of Journal, ledger and Trial Balance

- To understand the terms clearly

- To develop interest in the subject

- To develop knowledge of skill in accounting

- To have self-confidence and to have strong foundation in Basic of accounting.

AIDS

Blackboard, chalk and charts

Special teaching methods and activities

Methods (Inductive, Problem Solving, Deductive, Lecture, Assignment activity) like Role play, mock transaction, dramatization, choreography etc. activities were followed.

Procedure

According to the difficulties found in the students the preparation of Journal, Ledger and Trial balance were divided into several sections. Classes were taken accordingly in the following manner by providing interesting learning activity stated above.

Unit 1:

- Journal

- Teacher explain what is journal

- Meaning of journal

- Golden Rules of Accountancy

- Format of Journal

- How to prepare Journal entry

- What are steps in passing LF

- Narration Meaning

- Few examples.

Unit 2

- Ledger

- Meaning

- Why ledger?

- Uses of ledger

- Maintenance of ledger

- Types of ledger

- Format

- Rule in preparation

- Opening ledger A/c

- Posting Entries

- Balancing ledger

Unit 3

- Trial Balance

- Meaning

- Why Trial Balance

- Uses

- Format

- Rules in preparation

- Preparation of Trial Balance

General

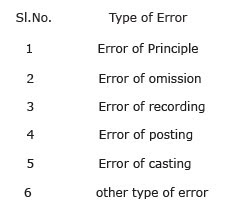

- What are types of errors?

- How to minimize these Errors

- Some intersections to avoid errors

- Motivate to have confidence in accounting

All the details of Journal, Ledger, Trial Balance were revised clearly. Students were supervised and encouraged to do the work with concentration. More Review questions were asked and students were allowed to ask doubts. Participation was encouraged more practice and drill was given.

- Appendix II (a) Unit Journal

- Appendix II (b) Unit Ledger

- Appendix II (c) Unit Trial Balance is enclosed

General Instructions:

The investigator gave general instruction two students in the class room with the help of block board, char, Aids other teaching methods and other interesting activity like role play, choreography, dramatization, mock transaction to make the class room atmosphere very interesting and meaningful.

The errors classified by the

The main reasons are carelessness and no proper attention to the concept. They fail to follow the correct principle. Students are poor in understanding the principles. Students must be given enough practice in the principles of accounting.

The main reasons are when the transactions are wrongly recorded this is due to lack of knowledge, understanding, concentration, and poor writing habit and visual defects.

Pupils who suffer from any physical ailment or where vitality is low, show a lack of disability to concentrate in posting. Emotional factors also play a major role. Over confidence in posting the informations recorded in the books of original entry.

Poor way of writing the amount (ie) numbers. Not following the order in writing the amount are the main reasons of error of casting. Then, lack of concentration when writing, the total of one page to the next page, carelessness, poor memory are the causes of the error of casting.

Appendix II (a)

JOURNAL

Objective

- To understand the meaning, features and advantages of Double entry system.

- To know the meaning and types of accounts

- To identity the rules of accounting

- To know the rules of debit and credit

- To know the meaning preparation of journal the investigator explains Double entry system.

Each transaction reveals two aspects

one aspect will be “receiving aspect”

or “incoming aspect” or “expenses / loss

aspect”. This is termed as the “Debit aspect”.

The other aspect will be “giving aspect” or “outgoing aspect “or” income / gain aspect”. This is termed as the “Credit aspect”.

These two form the basis of double entry system.

Special teaching methods and activities

This can be taught by Inductive, Problem Solving, Deductive, Lecture, Assignment method and activities like role play, dramatization, choreography and mock transaction etc. were followed.

AIDS: Black board, Chalk, Chart etc.

THE INVESTIGATOR LISTED THE FEATURES

Features:

- Every business transaction affects two accounts

- Each transaction has two aspects (i.e.) debit and credit.

- It is based upon accounting assumptions concepts and principles.

- Helps in preparing trail balance which is a test of arithmetical

- Preparation of final accounts with the help of trial balance.

What is an Account?

Account

Every transaction has two aspects and each aspect has an account. It is stated that “an account is a summary of relevant transactions at one place relating to a particular head.

Dramatization

Some students where asked to participate in the Drama, one was to maintain account and others were asked to act as a buyer, seller and some products were displayed and money was also involved. Here one person was asked to buy a pen for Rs. 10/- from the seller and it was accounted.

From this the investigator taught the rules of accounting i.e. personal account, real account and nominal account.

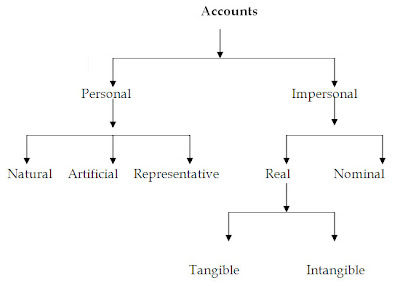

THE INVESTIGATOR CLASSIFIES THE ACCOUNTS

Calcification of account

- Transactions relating to individuals and firms

- Transactions relating to properties, goods or cash

- Transactions relating to expenses or losses and incomes and gains.

The investigator explains with chart

The investigator very clearly explains the following

Personal accounts

- Natural persons: Accounts which relate to persons, individuals, for (eg) Shankar A/c etc.

- Artificial persons: Accounts which relate to group of persons or firms or institutions for (eg) Indian Bank, life Insurance Corporation.

- Representative persons: Accounts which represent a particular person or group of persons. for (eg) outstanding salary account, prepaid insurance etc.

The investigator explains Impersonal accounts with lot of examples.

Role play

In the class room with regular learning teaching was done by the students to show a person for natural account and by showing a firm, bank setup for artificial person and showing persons who have already paid insurance amount for representative person.

II Impersonal accounts

(i) Real Accounts Accounts relating to properties and assets which are owned by the business concern. If includes tangible and intangible accounts for (eg) Land, Building, Furniture etc.

Mock transactions

Here students were asked to perform mock transactions and others to identify the assets namely land, building etc.

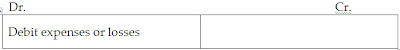

(ii) Nominal Accounts

These accounts do not have any existence, form or shape. They relate to incomes and expenses and gains and losses of a business concern. For (eg.) salary account, dividend account etc.

Choreography

Here the investigator along with regular teaching had a choreography to narrate the items under nominal account i.e. list of incomes and expenses

THE INVESTIGATES GIVES

Practice to the students to classily the items into personal, Real and nominal accounts.

Mock transactions

Here students were asked to perform mock transactions and others to identify the assets namely land, building etc.

(ii) Nominal Accounts

These accounts do not have any existence, form or shape. They relate to incomes and expenses and gains and losses of a business concern. For (eg.) salary account, dividend account etc.

Choreography

Here the investigator along with regular teaching had a choreography to narrate the items under nominal account i.e. list of incomes and expenses

THE INVESTIGATES GIVES

Practice to the students to classily the items into personal, Real and nominal accounts.

- Capital

- Sales

- Drawings

- Outstanding salary

- Cash

- Rent

- Interest paid

- Indian Bank

- Discount received

- Building.

Mime

A mime was performed by the students to understand the concepts of the items stated above

Answers

- Personal Account

- Real account

- Personal account

- Personal account

- Real account

- Nominal account

- Nominal account

- Personal account

- Nominal account

- Real account

The investigator gives

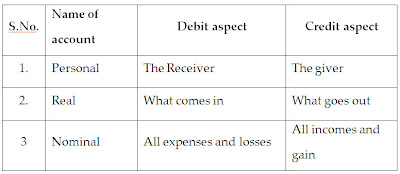

Clear explanation golden rules of accounting.

All business transistors are recorded on the basis of the following rules.

Golden rules of accountancy

Role play

Role playThe investigator made the students to perform a role play to show the receiver, giver, assets what comes in and what goes out, incomes and expenses etc. Thus the concept in the golden rules were clearly understood.

The investigator introduces the topic journal with a colourful chart were a transaction was written on it and receiver and giver was drawn in the form of stick figures.

Journal

Journal is date- wise record of all the transactions with details of the accounts debited and credited and the amount of each transition also recorded.

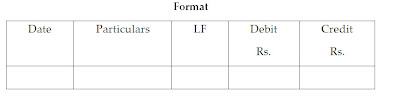

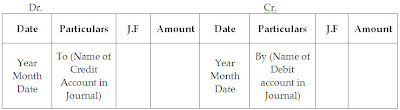

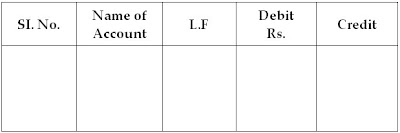

The investigator introduced the format of journal by showing a chart

Explanation of the format in Detail

1. Date

In the first column the date of the transaction is entered .The year and the month is written only once, till they change the sequence of the dates and month should be strictly maintained.

2. Particulars

Each transaction affects two accounts, out of which one account is debited and the other account is credited. The name of the account to be debited is written first, very near to the line of particulars column and the word account is also written at the end of the particulars column. Then in the second line, the name of the account to be credited is written and starts with the word ‘To’, a few space away from the margin in the particulars column to make it distinct from the debit account.

3. Narration

After writing the entry a brief explanation of the transaction together with necessary details is stated in the particulars column within the brackets which is called as narration the words ‘For’ or ‘being’ is used before starting to write the narration so by seeing the narration any one can understand the nature of transaction.

4. Ledger folio (L.F)

After passing the journal entries the next step is to post them into ledger accounts. The page number or folio number of the ledger, where the posting has been made from the journal is recorded in the L.F column of the journal till such time this column remains blank.

5. Debit amount

In this column, the amount of the account being debited is written.

6. Credit amount

In this column, the amount of the amount being credited is written.

Now the investigator clearly explains the steps in Journalizing with chart, Black board and chalk in a very simple way.

Student’s participation

Student’s were asked to write on the board one by one to enter the items in the prescribed format to gain more understanding.

Explanation on Business Transactions

Analysing, the business transactions under the debit and credit aspects and then recording them in the form of Journal is called Journalizing.

An entry made in Journal is called a ‘journal entry.’

Here the investigators explains the steps one by one.

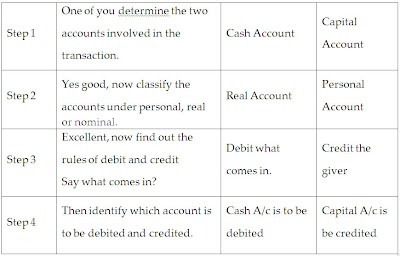

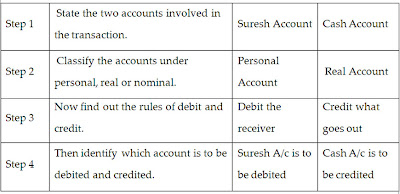

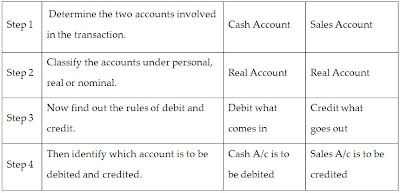

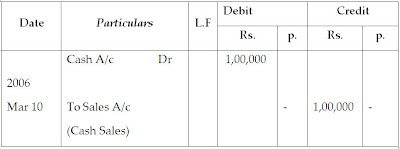

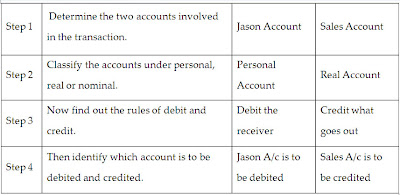

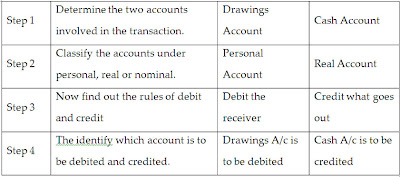

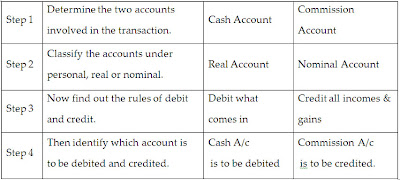

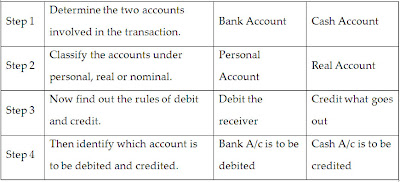

Step 1 The first step is to determine the two accounts which are involved in the transaction.

Step 2 Now we have to classify the above two accounts under personal account, Real and Nominal account

Step 3 With the help of the Golden Rules of Accounting find out the rules of debit and credit for the above two accounts.

Step 4 Then we have to identify which account is to be debited and which account is to be credited.

Step 5 Now we have to record the date of transaction in the date column. The year and month is written once, till they change. The sequence of the dates and months should be strictly maintained in their column.

Step 6 Then we have to enter the name of the account to be debited in the particulars column very close to the left hand side of the particulars column followed by the abbreviation Dr. in the same line. Against this, the amount to be debited is written in the debit amount column is the same line.

Step 7 Now we have to write the name of the account to be credited in the second line starts with the word ‘To’ a few space away from the margin in the particulars column. Against this, the amount to be credited is written in the credit amount column in the same line.

Step 8 Now we have to write the narration within brackets in the next line in the particulars column.

Step 9 Lastly we have to draw a line across the entire particulars column to separate one journal entry from the other.

Example 1:

January 1, 2006 Ramesh started business with Rs. 2,00,000

- Good

- Now debit cash A/c and credit Ramesh capital A/c

- The entry is

The ledger Folio column indicates 12 against Cash Account which means that Cash Account is found in page 12 in the ledger and the debit of Rs. 2,00,000 to Cash A/c can be seen on that page. Similar 45 against Capital A/c indicates the page number in which Capital account is found and the credit of Rs. 2,00,000 indicates there in.

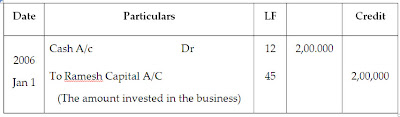

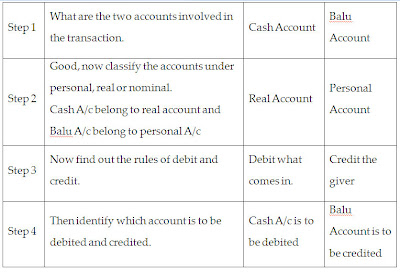

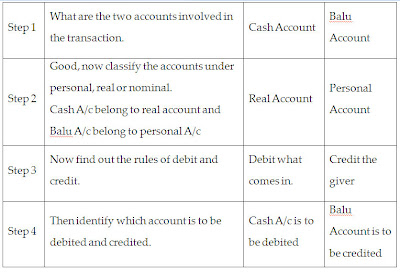

Example 2:

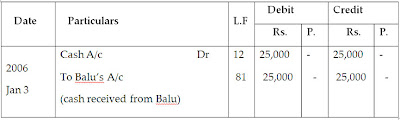

Jan. 3, 2006 Received cash from Balu Rs. 25,000

Role play

Two students were made to participate one received cash from another

Explanation:

Deductive method was followed the rules were explained and then by applying it students framed the entry.

Analysis of Transaction

Now debit cash account and credit is Balu A/c

The entry is

JournalExample 2:

Jan. 3, 2006 Received cash from Balu Rs. 25,000

Role play

Two students were made to participate one received cash from another

Explanation:

Deductive method was followed the rules were explained and then by applying it students framed the entry.

Analysis of Transaction

Now debit cash account and credit is Balu A/c

The entry is

The ledger Folio column indicates 12 against Cash Account which means that Cash Account is found in page 12 in the ledger and this debit of Rs. 25,000 to Cash account can be seen of that page. Similarly 81 against balu account indicates the page number in which Balu’s Account is found and the credit of Rs. 25,000 indicates there in.

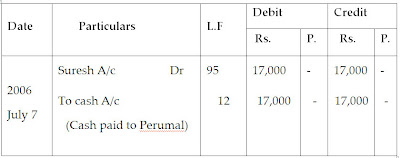

Example 3:

July 7, 2006 – Paid cash to Suresh Rs. 17,000.

Mock transaction

Transaction was depicted through this way and students were asked to identify

Now debit Suresh A/c and credit cash A/c.

Now debit Suresh A/c and credit cash A/c.The entry is

Journal

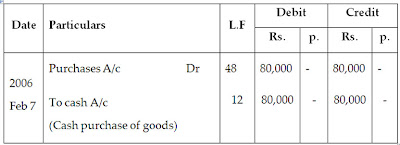

Example 4:

Example 4:Feb. 7, 2006 – Bought goods for cash Rs. 80,000.

Role play

Two students were asked to participate one as buyer and other as seller for buying a pencil

Examples 5:

Examples 5:March 10, 2006 - Cash sales Rs.1,00,000

Mock Transaction

The investigator did the act of selling in the class. One student was asked to do action of selling a product and the other was asked to identify it.

Analysis of Transaction

Debit cash Account and credit sales account

Debit cash Account and credit sales accountThe entry is

Journal

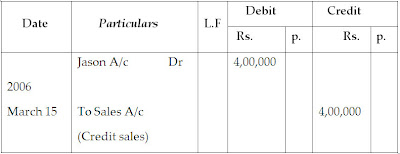

Example 6:

March 15, 2006 – Sold goods to Jason on credit Rs.4,00,000.

Explanation:

A clear explanation of credit of credit transaction (ii) selling the goods without getting cash) was given by the investigator and then asked the students to perform role play.

Role play

Two student were asked to participate one acted as Jason and the other student sold a product to Jason on credit

Analysis of Transaction

Debit Jason Account and credit sales Account

Debit Jason Account and credit sales AccountThe entry is

Journal

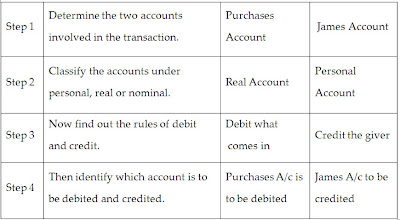

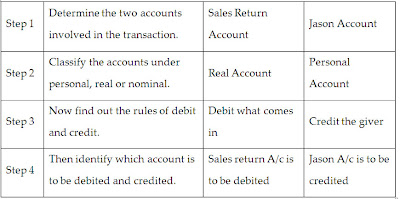

Example 7:

March 18, 2006 - Purchased goods from James on credit

Rs. 1,50,000.

Mime

Student were asked to participate one person purchased goods from James on credit.

Explanation:

Inductive method was followed the facts was presented through mime to form the rules in framing the entry.

Student were asked to participate one person purchased goods from James on credit.

Solution : Debit purchases Account and credit James Account the entry is

Solution : Debit purchases Account and credit James Account the entry isJournal

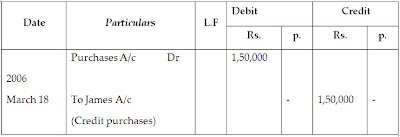

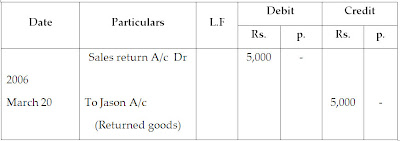

Example 8:

Example 8:March 20, 2006 Returned goods from Jason Rs. 5,000

Dramatization

Students were asked to perform a drama were sold goods was returned to Jason due to damage

Explanation:

Problem – solving method was followed by expressing the problem through drama and were asked to solve it.

Analysis of Transaction

Solution : Debit sales Return Account and credit Jason Account the entry is

Solution : Debit sales Return Account and credit Jason Account the entry isJournal

Example 9:

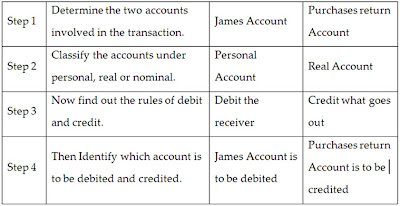

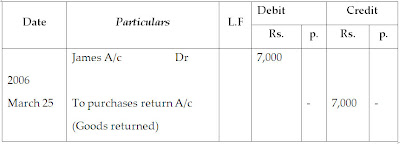

March 25, 2006 Goods returned to James Rs. 7,000

Dramatization

Students enacted that the purchase goods was returned to James due to damage.

Explanation:

The problem was exposed through drama and the students were asked to solve it.

Analysis of Transaction

Solution: Debit James Account and credit purchases Return Account the entry is

Solution: Debit James Account and credit purchases Return Account the entry isJournal

Example 10:

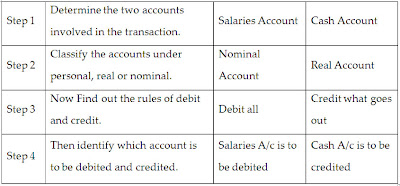

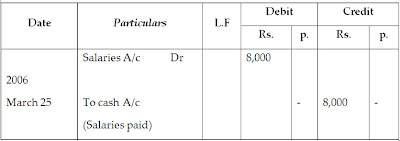

March 25, 2006 Paid salaries in cash Rs. 8,000

Mime

Some students were asked to do some work and salary for the work done was given

Explanation:

Deduction method was followed. The real situation was presented and the students were asked to pass the entry.

Analysis of Transaction

Solution: Debit salaries Account and credit cash Account the entry is

Solution: Debit salaries Account and credit cash Account the entry isJournal

Example 11:

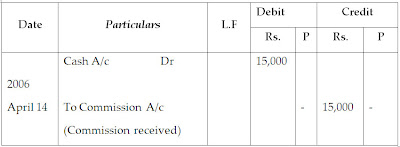

Example 11:April 14, 2006 Commission received Rs.15,000

Dramatization

Some special work was assigned to three students and for their work a percentage of commission was given.

Explanation:

Inductive method was followed using principles students were asked to pass the entry.

Analysis of Transaction

Solution: Debit cash Account and credit Commission Account the entry is

Journal

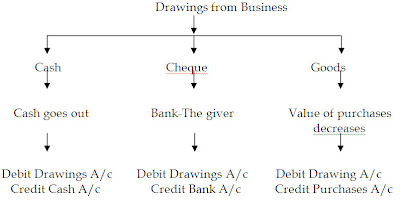

CAPITAL AND DRAWINGS

CAPITAL AND DRAWINGSExplanation

Capital is the amount invested into the business and drawing is the amount which is taken from the business for personal use.

Dramatization

Students were involved to show the cash and cheque dealings for purchase and sale of goods.

Example 12:

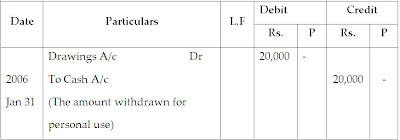

January 31, 2006 Ramesh withdrew for personal use Rs. 20,000.

Dramatization

A business set up was formed and money was taken from the business for personal use

Explanation:

Students were asked to write the entry on the board.

Analysis of Transaction

Solution: Debit drawings Account and credit cash Account the entry is

Journal

BANK TRANSACTIONS

Explanation

Any transaction for which bank is involved like cheque, bills received etc.

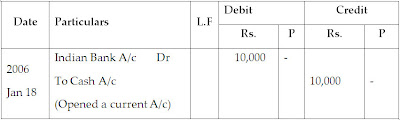

Example 13

January 18, 2006 Opened a current account with Indian

Bank 10,000

Role play

Business person were set in the class to show the dealing of current account in the bank

Explanation:

Deductive method was followed using the knowledge about the business dealings and were asked to pass the entry

Solution : Debit Bank Account and credit cash Account the entry is

Journal

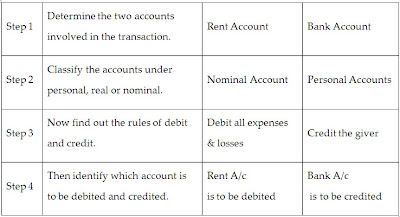

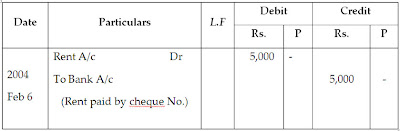

Example 14:

Feb 3, 2006 Rent paid by cheque Rs.5,000

Mime

Students represented the payment of the rent by cheque

Explanation:

Students were asked to observes and write the entry.

Analysis of Transaction

Solution: Debit Rent Account and credit Bank Account the entry is

Journal

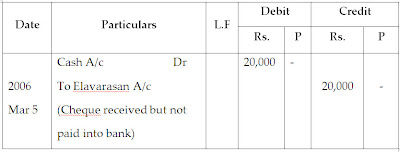

Example 15 :

March 5, 2006 Received cheque from Elavarasan Rs 20,000.

Role play

Student’s participated to show that a person are business received cheque from another person.

Explanation:

The students were asked to observe and investigator explained that received cash should be treated as cash.

Analysis of Transaction

Solution : Debit cash Account and credit Elavarasan account the entry is

Journal

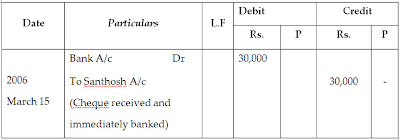

Example 16:

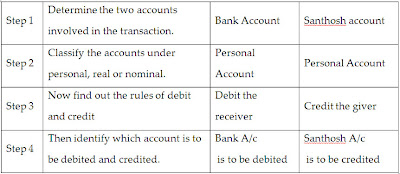

March 15, 2006 - Cheque received from Santhosh Rs.30,000 and immediately banked.

Choreography

Depicting the cheque is received from a student Santhosh in the class

Explanation:

Since cheque received is banked, receipt of cheque is treated as bank

Analysis of Transaction

Solution: Debit Bank Account and credit Santhosh Account the entry is

Journal

Compound Journal Entry

Example 17:

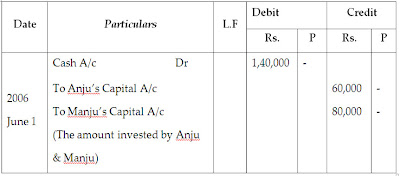

June 1, 2006 - Anju contributed capital Rs. 60,000 Manju contributed capital Rs. 80,000.

Dramatization

Students started business with cash in the class.

Explanation:

Lecture method was used to teach this concept more clearly.

Solution: Debit cash Account because cash comes in and credit capital Account

Journal

Example 18

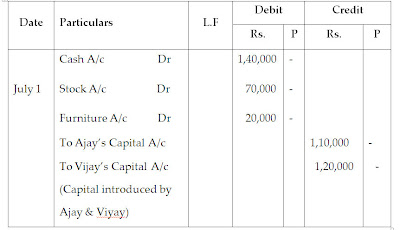

July 1, 2006 Ajay contributed capital Cash Rs.90,000 Furniture Rs.20,000. Vijay contributed capital –Cash Rs.50,000 Stock Rs. 70,000

Dramatization

Student’s started business with cash furniture and other assets.

Explanation:

Lecture method was followed to teach the entry in detail.

Solution

Debit cash Account stock Account and Furniture Account because it comes into the business and credit capital Account.

Example 19:

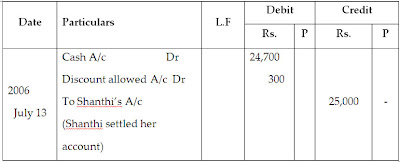

Example 19: July 13, 2006 Received cash Rs. 24,700 from Shanthi in full settlement of her account of Rs. 25,000.

Role play

Students had a role play and received money from a student Shanthi for her settlement of account after discount.

Here cash received is Rs. 24,700 in full settlement of Rs. 25,000 so the difference Rs. 300 is discount allowed.

Explanation:

Problem solving method was followed in the class discussion on this transaction was made clear by the investigator.

Solution

Example 20:

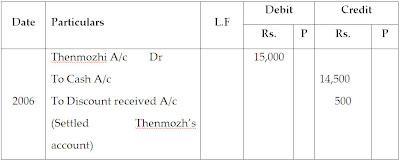

Example 20:July 14, 2006 Paid cash to Thenomozhi Rs 14,500 in full settlement of her account of Rs. 15,000

Mime

Mime was performed that cash was paid to another person in full settlement.

Explanation:

Problem solving method was used to solve the above transaction. Here cash paid Rs. 14,500 in settlement of Rs. 15,000 the difference Rs. 500 is discount received.

Journal

Bad Debts

When the goods are sold to a customer on credit and if the amount becomes irrecoverable due to his insolvency or for some other reason, the amount not recovered is called bad debts. For recording it, the bad debts account is debited because the unrealised is a loss the business and the customer’s account is credited.

Dramatization

Students joined together to show how baddebt’s occurs one student acted due to insolvency is not paying the due amount and to another student.

Explanation:

Lecture method was adopted by the investigator to give clear idea about baddebts.

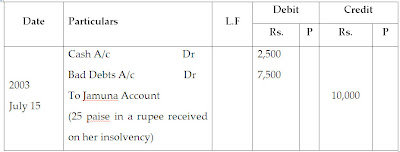

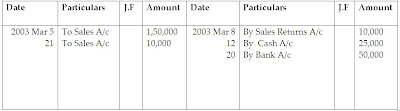

Example 21:

Jamuna who owed us Rs. 10,000 is declared insolven and 25 paise in a rupee is received from her on 15th July, 2003.

Solution

Bad Debts Recovered

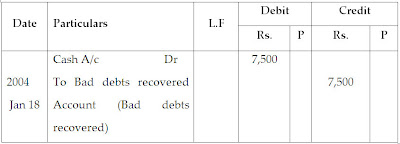

Sometimes, it so happens that the bad debts previously written off are subsequently recovered. In such case, cash account is debited and bad debts recovered account is credited because the amount so received is a gain to the business.

Example 22:

Received cash for a Bad debt written off last year Rs. 7,500 on 18th Jaunary, 2004

Mime

A student was representing that amount which was not cleared last year is paid for the same in this year to another student

Explanation:

Problems solving method was adopted by the investigator and the students were asked to pass entry.

Journal

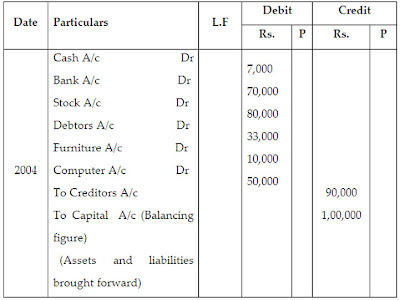

4.5.5. Opening Entry

Opening Entry is entry which is passed in the beginning of each current year to record the closing balance of assets and liabilities of the previous year. In this entry asset accounts are debited and liabilities and capital account are credited. If capital is not given in the question, it will be found out by deducting total of liabilities from total of assets.

Example 23:

The Following balances appeared in the books of Malarkodi as on Ist January 2004 Cash Rs. 7,000, Bank Rs. 70,000, Stock Rs. 80,000, Furniture Rs. 10,000, Computer Rs. 50,000, Debtors Rs. 33,000 and Creditors Rs. 2,50,000.

Dramatization

A student was assigned to be as a owner of the business and in the beginning of the year cash and other assets, liabilities are listed to begin this year account.

Explanation:

Lecture method was followed by the investigator to explain the passing of the opening entry.

The opening entry is

Journal

Advantages

The main advantages of the Journal are:

- It reduces the possibility of errors.

- It provides an explanation of the transaction.

- It provides a chronological record of all transactions.

Limitations

- It will be too long if all transactions are recorded here.

- It is difficult to ascertain the balance of each account.

Appendix II (b)

LEDGER

Learning Objectives

- To understand ledger.

- To understand the Meaning and Procedure for posting.

- To know the procedure for Balancing and the Significance of Balances.

- To know the Relation between, Journal and ledger.

The investigator explained the chapter ledger in small units step by step with proper teaching aids in a simple way.

Special teaching Methods and Activities

Inductive, Deduction, Lecture, Problem solving, Achievement and other activities like role play, choreography, dramatization etc.

AIDS: Black board, chalk and chart.

Explanation

In Journal, each transaction was dealt separately. Therefore, it is not possible to know at a glance, the net result of many transactions. So, in order to ascertain the net effect of all the transactions relating to a particular account are collected at one place in the Ledger.

A Ledger is a book, which contains all the accounts whether personal, real or nominal, which are first entered in Journal or special purpose subsidiary books.

According to L.C. Cropper, ‘the book which contains a classified and permanent record of all the transactions of a business is called the Ledger.

Investigator states the utility of ledger

Ledger is a principal or main book which contains all the accounts in which the transactions recorded in the books of original entry are transferred. Ledger is also called the ‘Book of Final Entry’ ‘or’ ‘Book of Secondary Entry; because the transactions are finally incorporated in the Ledger. The following are the advantages of ledger.

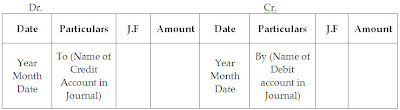

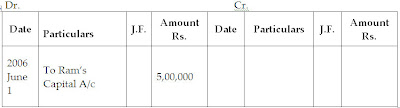

Investigator explains the format by using the chart and explains the Debit and the Credit side

Format

Name of Account

Explanation

Special teaching Methods and Activities

Inductive, Deduction, Lecture, Problem solving, Achievement and other activities like role play, choreography, dramatization etc.

AIDS: Black board, chalk and chart.

Explanation

In Journal, each transaction was dealt separately. Therefore, it is not possible to know at a glance, the net result of many transactions. So, in order to ascertain the net effect of all the transactions relating to a particular account are collected at one place in the Ledger.

A Ledger is a book, which contains all the accounts whether personal, real or nominal, which are first entered in Journal or special purpose subsidiary books.

According to L.C. Cropper, ‘the book which contains a classified and permanent record of all the transactions of a business is called the Ledger.

Investigator states the utility of ledger

Ledger is a principal or main book which contains all the accounts in which the transactions recorded in the books of original entry are transferred. Ledger is also called the ‘Book of Final Entry’ ‘or’ ‘Book of Secondary Entry; because the transactions are finally incorporated in the Ledger. The following are the advantages of ledger.

Investigator explains the format by using the chart and explains the Debit and the Credit side

Format

Name of Account

Explanation

- Each ledger account is divided into two parts. The left hand side is known as the debit side and the right hand side is known as the credit side. The words ‘Dr’. and ‘Cr’ are used to denote Debit and Credit.

- The name of the account is mentioned in the top (middle) of the account

- The date of the transaction is recorded in the date column.

- The word ‘To’ is used before the accounts which appear on the debit side of an account in the particulars column. Similarly, the word ‘By’ is used before the accounts which appear on the credit side of an account in the particulars column.

- The name of the other account which is affected by the transactions is written either in the debit side or credit side in the particulars column.

- The page number of the Journal or Subsidiary Book from where that particular entry is transferred is entered in the Journal Folio (J.F.) column.

- The amount pertaining to this account is entered in the amount column

Personal Accounts

Real Accounts

Salaries Account

Commission Received Account

Commission Received Account

Investigator explains the Ledger posting

When the entries recorded in the journal or subsidiary books to the respective accounts opened in the ledger is caller Posting.

EXPLANATION

Procedure Of Posting

1. Procedure of posting for an Account which has been debited in the journal entry

Step 1 Locate in the ledger, the account to be debited and enter the date of the transaction in the date column on the debit side.

Step 2 Record the name of the account credited in the Journal in the particulars column on the debit side as “To .... (name of the account credited).

Step 3 Record the page number of the Journal in the J.F column on the debit side and in the Journal, write the page number of the ledger on which a particular account appears in the L.F. column.

Step 4: Enter the relevant amount in the amount column on the debit side.

2. Procedure of posting for an Account which has been credited in the journal entry

Step I Locate in the ledger the account to be credited and enter the date of the transaction in the date column on the credit side

Step 2 Record the name of the account debited in the Journal in the particulars column on the credit side as “By .... (Name of the account debited).

Step 3 Record the page number of the Journal in the J.F column on the credit side and in the Journal, write the page number of the ledger on which a particular account appears in the L.F. column.

Step 4 Enter the relevant amount in the amount column on the credit side.

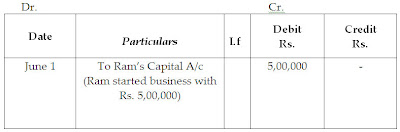

Example 1

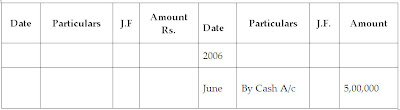

Mr. Ram started business with cash Rs. 5,00,000 on 1st June 2006. The above transaction will appear in Journal and Ledger as under.

Explanation:

Problem solving method was used to pass Journal and post in Ledger. Now first pass the journal and then from the journal we have post in the ledger using the steps for preparing ledger.

Solution

Question

How many accounts are involved?

Answer

Two accounts are involved, Cash Account and Ram’s capital account, so we should allot in the ledger a page for each account.

Explanation:

Deductive method was used for to prepare this Ledger A/c. Rules were stated and explanation was given to prepare cash. Now first open cash Account from the above journal in cash Account To Rams capital account must be debited.

This is the method of posting journal in the ledger A/C

Question : What is the next Account?

Answer : Ram’s capital Account.

Yes, By using the same step we have to post the entry into Ram’s capital A/C.

By cash Account shoul,d be credited in Rams capital account we are just posting but not balancing it.

Ram’s Capital Account

Now we will do the example

Example 2

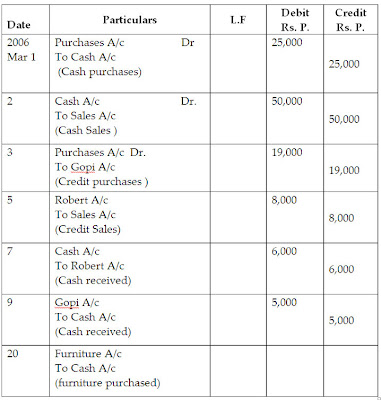

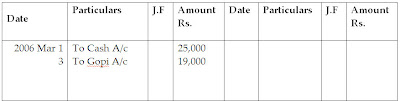

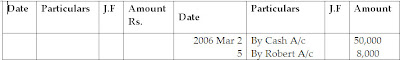

Journalise the following transactions in the books of Kumar and post them in the Ledger.

2006

March 1 Bought goods for cash Rs.25,000

2 Sold goods for cash Rs.50,000

3 Bought goods for credit from Gopi Rs.19,000

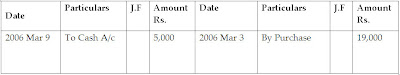

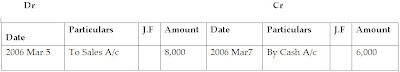

5 Sold goods on credit to Robert Rs. 8,000

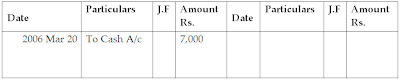

7 Received from Robert Rs.6,000

9 Paid to Gopi Rs.5,000

20 Bought furniture for cash Rs.7,000

Explanation:

Problem solving method was used by the investigator to do it step by step using the rules of accounting

FIRST WE HAVE TO PASS JOURNAL FOR ALL THE TRANSACTIONS AND THEIR PREPARE LEDGER.

Solution: Journal of Mr. Kumar

We have passed Journal

We have passed JournalQuestion : List all the accounts from the journal?

Answer : There are six accounts involved: Cash, Purchases, Sales, Furniture, Gopi & Robert.

Yes, good

Question : How many Accounts are there?

Answer : Six

So we have to open six accounts.

Now, Open each account one by one

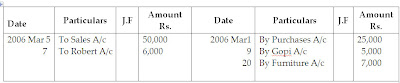

First we have to open cash accounts

All entries which deals with cash must be taken and leaving cash the next aspect must be debited or credited accordingly.

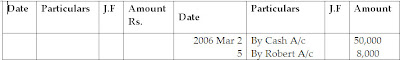

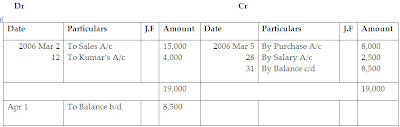

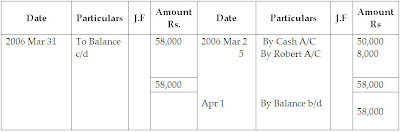

Ledger of Mr. Kumar

Cash Account

Cash Account

Here we are just posting

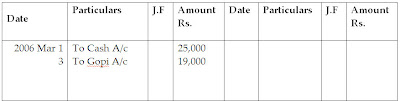

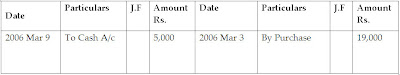

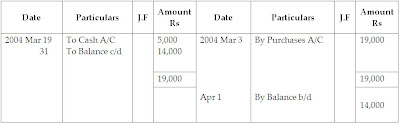

Next open purchases Account here all entries which deals with purchases must be taken and leaving purchase the other aspect must be recorded accordingly.

Question : To prepare purchases A/c what should be considered?

Answer : All entries relating to purchase should be considered.

Purchases Account

Here also we are just posting not balancing next open sales account. In this account entries dealing with sales is taken and posted according

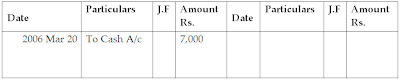

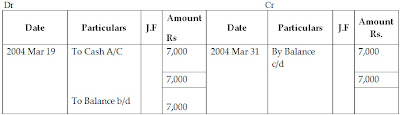

Now open the next Account () Furniture Account items relating to furniture is taken and leaning furniture the other aspect To cash’ is entered

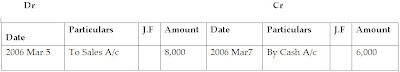

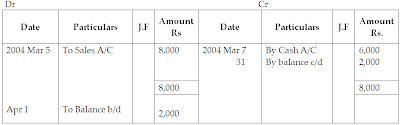

Next open Gopi Account In this Account enteries dealing with taken and leaving Gopi the either aspect is as By purchase on credit and to cash Account on debit.

Posting of Compound Journal Entries

Compound or Combined Journal Entry is one where more than one transactions are recorded by passing only one journal entry instead of passing several journal entries. Since every debit must have the corresponding equal amount of credit, special care must be taken in posting the compound journal entry, where there may be only on debit aspect but many corresponding credit aspects of equal value or vise versa. The posting of such transactions is done in the same way as already explained.

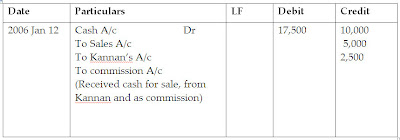

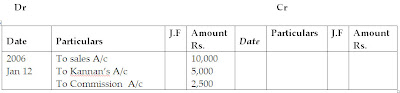

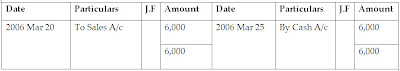

Example 3

Jan, 12, 2006 Cash sales Rs. 10,000 Cash received from Kamnna Rs.5,000 and commission earned Rs. 2.500

JournalNext open purchases Account here all entries which deals with purchases must be taken and leaving purchase the other aspect must be recorded accordingly.

Question : To prepare purchases A/c what should be considered?

Answer : All entries relating to purchase should be considered.

Purchases Account

Here also we are just posting not balancing next open sales account. In this account entries dealing with sales is taken and posted according

Now open the next Account () Furniture Account items relating to furniture is taken and leaning furniture the other aspect To cash’ is entered

Next open Gopi Account In this Account enteries dealing with taken and leaving Gopi the either aspect is as By purchase on credit and to cash Account on debit.

Posting of Compound Journal Entries

Compound or Combined Journal Entry is one where more than one transactions are recorded by passing only one journal entry instead of passing several journal entries. Since every debit must have the corresponding equal amount of credit, special care must be taken in posting the compound journal entry, where there may be only on debit aspect but many corresponding credit aspects of equal value or vise versa. The posting of such transactions is done in the same way as already explained.

Example 3

Jan, 12, 2006 Cash sales Rs. 10,000 Cash received from Kamnna Rs.5,000 and commission earned Rs. 2.500

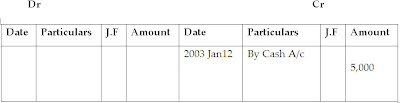

Ledger

Ledger

An cash Account from above journal cash account is left and other items to sales, to Kannan To commission

Sales Account

Here By Cash is credited with sales amount Rs. 10,000

Here also By cash Account is Rs 5,000 Credited in Kannan’s

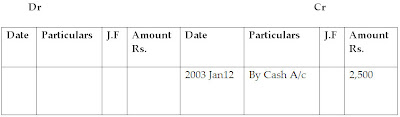

Here also By cash Account is Rs 5,000 Credited in Kannan’sKannan’s Account

In this account also by cash Account is credited with Rs. 2500

Commission Account

Note : In the above transactions, there is only one debit aspect namely cash account and three credit aspects. Therefore, while posting in the cash account, the names of three credit aspects are entered in the cash account on the debit side, thus having a total of Rs. 17,500 which is equal to the amount in the debit column of the journal.

The cash account is written on the credit side of the three accounts, namely, Sales, Kannan and Commission received, as it acts as an opposite and corresponding accounts for Sales Rs. 10,000, Kannan Rs 5,000 and Commission Rs. 2,500 respectively which are equal to the amount in the credit column of the journal.

Posting the Opening Entry

The opening entry is passed to open the books of accounts for the new financial year. The debit or credit balance of an account what we get at the end of the accounting period is known as closing balance of that account. This closing balance becomes the opening balance in the next accounting year.

The procedure of posting an opening entry is same as in the case of an ordinary journal entry. An account which has a debit balance, the words ‘To balance b/d’ are recorded on the debit side in the particulars column. An account which has a credit balance, the worlds “By balance b/d” are recorded in the particulars column. An account which has a credit balance, the words “By balance b/d” are recorded in the particulars column on the credit side. Infact opening entry is not actually posted but the accounts are merely incorporated in the ledger, if the ledger is a new one or old.

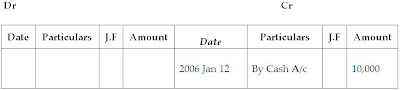

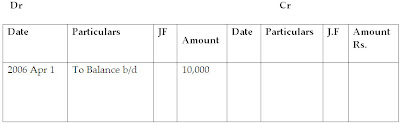

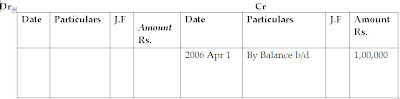

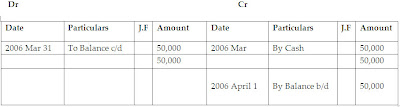

Example

Post opening entry into the ledger of Rajan as on I st APril 2006 cash in hand Rs. 10,000 Loan Rs. 1,00,000.

Solution:

In the Books of Rajan

Cash Account

Cash Account

Loan Account

Balancing an Account

Balance is the difference between the total debits and the total credits of an account. When posting is done, many accounts may have entries on their debit side as well as credit side. The net result of such debits and credits in an account is the balance.

Balancing means the writing of the difference between the amount columns of the two sides in the lighter (smaller total) side, so that the grand totals of the two sides become equal.

Significance of balancing

There are three possibilities while balancing an account during given period. It may be a debit balance or a credit balance or a nil balance depending upon the debit total and the credit total.

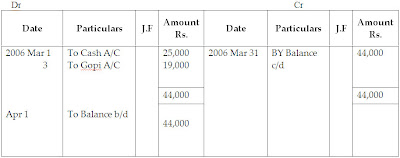

Debit Balance : The excess of debit total over the credit total is called the debit balance. When there is only debit entries in an account the amount itself is the balance of that account, i.e., the debit balance. It is first recorded on the credit side, above the total. Then it is entered on the debit side, below the total, as the first item for the next period.

Cash Account

Credit Balance: The excess of credit total over the debit total is called the credit balance. When there is only credit entries in account, the amount itself is the balance of that account i.e, the credit balance. It is first written in the debit side, as the last item, above the total. Then it is recorded on the credit side, below the total, as the first item for the next period.

Capital Account

iii. Nil Balance: When the total of debits and credits are equal, it is closed by merely writing the total on both the sides. It indicates the equality of benefits received and given by that account.

iii. Nil Balance: When the total of debits and credits are equal, it is closed by merely writing the total on both the sides. It indicates the equality of benefits received and given by that account.Shankar Account

5.4.2 Balancing of different accounts

Balancing is done periodically, i.e., weekly, monthly, quarterly, yearly or yearly, depending on the requirements of the business.

i. Personal Accounts

These accounts are generally balance regularly to know the amounts due to the persons (cerditors ) or from the persons (debtors).

ii. Real Accounts:

These accounts are generally balanced at end of teh financial year, when final accounts are being prepan However, cash account is frequently balanced to know the cask on has. A debit balance in an asset account indicated the value of the as owned by the business. Assets accounts always show debit balance.

iii. Nominal Accounts:

These account are in fact, not to balanced as they are to be closed by transfer to final accounts. A de balance in a nominal account indicates that it is an expense or loss credit balance in a nominal account indicates that it is an income gain.

All such balances in personal and real accounts are shown in Balance Sheet and the balances in nominal accounts are taken to Profit and Loss Account.

5.4.3. Procedure for Balancing

While balancing an account, the following steps are involved.

Step 1 Total the amount column of the debit side and the cred side separately and then ascertain the difference of the columns.

Step 2 If the debit side total exceeds the credit side total, put such difference on the amount column of the credit side, write the date on which balancing is being done in the date column and the words “By Balance c/d” (c/d means carried down in the particulars column.

If the credit side total exceeds the debit side total, put such difference on the amount column of the debit side, write the date on which balancing is being done in the column and the words “To Balance c/d” in the particulars column.

Step 3 Total again both the amount columns, put the total on both the sides and draw a line above and a line below the totals.

Step 4 Enter the date of the beginning of the next period in the date column and bring down the debit balance on the debit side along with the words “To Balance b/d” (b/d means brought down) in the particulars column and the credit balance on the credit side along with the words “By balance b/d” in the particulars column.

Note : In the place of c/d and b/d, the words c/f or c/o (carried forward or carried over) and b/f or b/o (brought forward or brought over) may also be used. When the balance is carried down in the same page, the words c/d and b/d are used, while balance is carried over to the next page, the term c/o and b/o are used. When balance is carried forward to some other page either in same book or some other book, the abbreviations c/f (carried forward) and b/f (brought forward) are used.

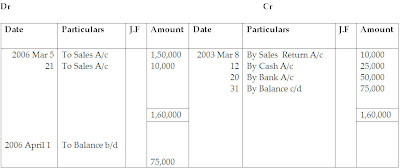

Example 5

Balance the following ledger Account as on 31st March 2003

Explanation:Deductive Method of follow by investigator to balance the ledger account

Explanation:

The steps involved in balancing Siva’s Account

Step 1 Total the amount column of the debit side Rs 1,60,00

Total the amount column of the credit side Rs 85,000

Balance / Difference Rs. 75.000

Since the total of debit amount column exceeds the total of credit amount column, the difference is Debit balance.

Step 2 Enter the date of balancing, which is normally the last date of the accounting period (i.,e., 31 st March 2003) in the date column, “by Balance c/d” in the particulars column, and the difference in the amount column on the credit side.

Step 3 Total both the amount columns and draw a line above and line below the totals.

Step 4 Enter the date of the beginning of the next period in the date column (i., e., 1st April 2003). ‘To Balance b/d’ in the particulars column and enter the balance amount in the amount column on the debit side.

After taking into consideration of the above steps, Siva’s Account will appear as follows.

Siva's Account

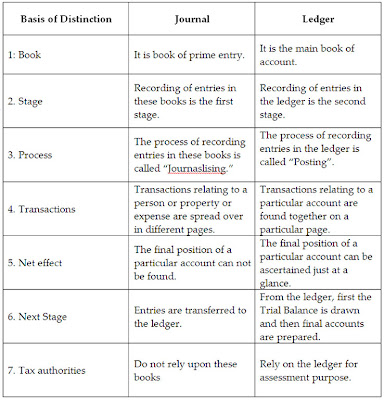

Distinction between Journal and Ledger:

Explanation: Investigator gave a clear explanation with chart, block board, chalk and students participation.

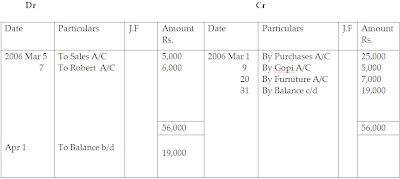

Example 6

Balance the ledger accounts for Exmaple 2. Solution:

Cash Account

Purchases Account

Sales Account

Furniture Account

Gopi Account

Robert Account

Appendix – II (c)

TRIAL BALANCE

Definition

“Trial balance is a statement, prepared with the debit and credit balances of ledger accounts to test the arithmetical accuracy of the books” – J.R. Batliboi.

Objectives

The objectives of preparing a trial balance are:

- To check the arithmetical accuracy of the ledger accounts.

- To locate the errors.

- To facilitate the preparation of final accounts.

Special teaching methods and activities

Inductive, Deductive, Problem solving method and activities like Role play, Mock transactions, dramatization, choreography etc were followed.

AIDS: Black board, chalk, chart etc were followed.

Advantages

The advantages of the trial balance are

- It helps to ascertain the arithmetical accuracy of the book- keeping work done during the period.

- It supplies in one place ready reference of all the balances of the ledger accounts.

- If any error is found out by preparing a trial balance, the same can be rectified before preparing final accounts.

- It is the basis on which final accounts are prepared.

Methods

A trial balance can be prepared in the following methods.

- The Total Method. According to this method, the total amount of the debit side of the ledger accounts and the total amount of the credit side of the ledger accounts are recorded.

- The Balance Method: In this method, only the balances of an account either debit or credit, as the case may be, are recorded against their respective accounts.

- The balance method is more widely used, as it supplies ready figures for preparing the final accounts.

Explanation:

Investigator prepared a chart to explain the format of Trail Balance.

Format

Trial Balance of ABC Ltd as on .................................

Stated the points

- Date on which trial balance is prepared should be mentioned at the top.

- Name of Account column contains the list of all ledger accounts.

- Ledger folio of the respective account is entered in the next column.

- In the debit column, debit balance of the respective account is entered.

- Credit balance of the respective account’s written in the credit column.

- The last two columns are totalled at the end.

Sundry Debtors and Sundry Creditors

In the ledger there are many personal accounts, some of them may show debit balances. If all the names are to be written in the trial balance it will be unduly long. Therefore, a list of names with the debit balances is prepared. This list is known as “ Sundry Debtors’ (Sundry means ‘many’). Similarly, a list of names with the credit balances is prepared. This list is known as ‘Sundry Creditors.’

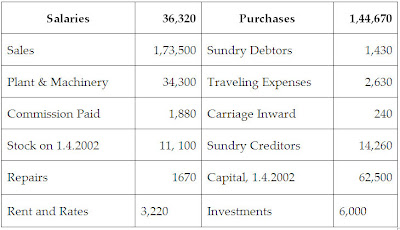

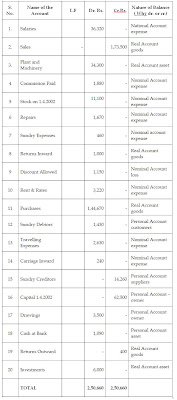

The following balances were extracted from the ledger of Rahul on 31March, 2003. You are requested to prepare a trial balances as on that date in the proper form.

Student’s participation

Student’s were involved to tell the debit and credit items through mock transactions. They identified the item when it was presented.

Solution

Trial Balance of Rahul as on 31 March, 2003

Appendix - III

MMRT

[Multimedia Remedial Teaching Material]

Multimedia Method

Hello Students,

Now we are going to learn Accountancy Unit namely Journal , Ledger and Trial Balance through multimedia method slide by slide you can see each slide one by one clearly.

You can stop at any point and also go ahed. If you have any doubt you can feel free to ask doubt and I will also give explanation and instruction in between you can go unit wise (i) Journal (ii) Ledger (iii) Trail Balance after finishing it, you shall proceed to the next stage, otherwise you shall review the same stage, you should give answers for the questions after completion.

Introduction The ever expanding field of education among the human race has necessitated a continuous modification and innovation of its technology.

The current education scene is in an information age where there is knowledge explosion and skills essential for living has become increasingly complex and interdependent.

Materials are generally developed in the form of Programmed learning, Computer Assisted Instruction, Instructional Modules, Multimedia method etc.

The students are made to sit infront of the computer and necessary instructions where given to start the work. They were asked to click on to the multimedia method. Here you can view each slide clearly and then go to next slide like this you can learn each and every unit one by one thoroughly.

No comments:

Post a Comment